What Does General Liability Insurance Cover?

General Liability Insurance protects your business, to the limits of your policy, against claims you are legally obligated to pay stemming from bodily injury or property damage caused to another person(s) or property.

The term “General” is a tip-off as to the wide range risks that are covered under this type of policy, including many of the most common lawsuits that can threaten your businesses security. As a business owner I understand the importance of operating with care; of constantly evaluating systems, checking and rechecking, in order to provide the best service free from errors. As an insurance agent, I have seen even our most careful clients occasionally hit with a claim- When that happens it is critical that you are protected by General Liability Insurance.

It is often what you don’t see coming that hits you the hardest. General Liability Insurance covers your business against a wide range of potential claims that can inflict serious damage to your business. With one call to Urban Insurance, we will listen to you, and examine risks, and then walk you through options to better protect all you have worked hard to build.

It is critical to remember that General liability coverage is limited to non-employee injuries, for protection for your own employees your company will need to obtain Workers Compensation insurance. We also offer Errors and Omission, Product Liability and Completed Operations Insurance. These coverages can be sold separately or as a package.

Have Questions or Prefer to Talk to an Agent? No problem.

Just give us a call at 1-800-680-0707 or have one of our agents call you.

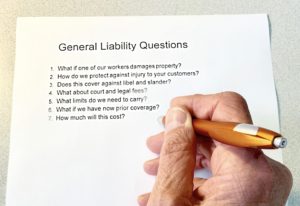

General Liability Questions

1. What if one of our workers damages property?

If the damage is caused by a vehicle owned or operated by your company, then the damage will fall under your Commercial Auto policy. If the property is destroyed, or in need of repair, as the result of a claim stemming from damage caused by you or your employees, general liability will often cover you.

2. How do we protect against injury to your customers?

General Liability is an important layer of protection, but it is important to speak to one of our agents to evaluate what exposure you face and what coverages will be needed. For example, General liability insurance will not substitute for cargo insurance or Product Liability.

3. Does this cover against libel and slander and What about court and legal fees?

Yes, there are legal protections and defense expenses that are typically covered as apart of general liability policies.

4. What limits do we need to carry?

The limits of liability you need will be determined by the nature of your business and the risks you face. Often the amount of insurance you select will be based on satisfying the requirements of any companies who ask you to present Certificates of Insurance as a condition of working with them. Common Limits are $100,000/$300,000/$50,000, $500,000 CSL and $1,000,000CSL.

5. What if we have no prior coverage?

Urban can help you find the coverage you need at the lowest possible price.

6. How much will this cost?

We have $1,000,000CSL policies starting at $695 per year.

Have Questions or Prefer to Talk to an Agent? No problem.

Just give us a call at 1-800-680-0707 or have one of our agents call you.

Urban Insurance Agency

800 West Huron Street

Suite #301

Chicago, IL 60642

312-664-8088

General Liability Insurance