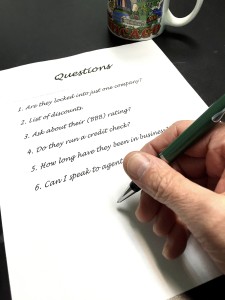

Asking questions before buying insurance is the best way to avoid not receiving the insurance coverage you want. I understand no one likes buying car insurance, in fact I’ve never met a person that didn’t have a list of ways they would rather spend their money. Clearly the idea is to get the auto Insurance you need while paying the least possible. so we have listed 6 Questions to Ask Before Buying Insurance.

Asking questions before buying insurance is the best way to avoid not receiving the insurance coverage you want. I understand no one likes buying car insurance, in fact I’ve never met a person that didn’t have a list of ways they would rather spend their money. Clearly the idea is to get the auto Insurance you need while paying the least possible. so we have listed 6 Questions to Ask Before Buying Insurance.

1. Ask how many companies will be shopped to find the best possible rate.

The larger the number of options, the more freedom your insurance agent has to avoid trying to “Fit” a customer into a policy that does not completely match their needs. You’ll also have a better chance of getting a lower rate.

2. Ask for a list of potential discounts up front.

Discounts should include “Good student,” Renewal and Transfer rates, “Safe driver,” “Loss-Free” and “multi-policy”. They should have a checklist approach to maximizing discounts, therefore lowering your insurance rate.

3. Ask about their Better Business Bureau (BBB) rating.

You should only work with companies that have an A rating or above. Every company, if in business long enough will have some customer that’s unhappy, but the important thing is that the company you select will work hard to solve any misunderstanding and has a track record to prove their dedication

4. Ask whether a credit check will be run prior to quoting insurance rates.

And if the answer is yes, will it be considered a hard or soft credit check. Also, ask whether your credit score will determine the cost of your insurance. More and more companies are running credit checks prior to providing an insurance quote. For example, Progressive, Geico car insurance, State Farm and esurance.com, are among a list of carriers that will not provide an insurance quote without first pulling your credit report.

5. Ask how long their company has been in business.

If less than 10 years, you should probably shop for insurance elsewhere. Insurance is a complex business, and you want a company “that’s been there, done that”.

6. Ask if you will be speaking to your agent when you have an issue.

When you actually need your insurance, you’re going to want the comfort of talking directly to a person. Getting a hold of a person who knows and has a relationship with you is incredibly important. What you don’t want is a telephone menu – “Press 1 for, Press 2 for…”

By knowing these 6 Questions to Ask Before Buying Insurance you will be better able to protect your interests, and get the lowest rates on the coverage you need.

Urban Insurance has been in business since 1961, we’ve certainly been there and done that – and our outstanding customer service has earned us an A+ rating from the Better Business Bureau. When we prepare a quote for you, we compare plans and rates across 20 different companies to find the best possible coverage at the lowest price. One way we get the lowest price is to ensure that we ask for every applicable discount (we’ve got a long list). And, when you call us – you’ll be connected to a living, breathing person. Go ahead – try it now.

(800) 680-0707 or click here to complete an application for auto insurance.

Urban Insurance Agency 800 W Huron St Ste 301 Chicago , IL 60642 (312) 664-8088 Fax # 312-664-7193 Additional Insurance Information |